The Lacey Act is relevant for consumer brands in the sense that it covers wood and other plant products. It also covers animal and other wildlife products. In this guide, you will learn what US companies must be aware of when it comes to its product scope, declaration requirements, and much more.

Content Overview

FREE CONSULTATION CALL (30 MIN)

Ask questions about compliance requirements

Ask questions about compliance requirements Countries/markets:

Countries/markets:

Learn how we can help your business

Learn how we can help your business

You will speak with:Ivan Malloci or John Vinod Khiatani

What is the Lacey Act?

The Lacey Act is a US federal legislation that was enacted in 1900. Its aim was to prevent the trafficking of illegally obtained wildlife, fish, and plants. After numerous amendments, its protection was extended to cover plant products.

To fulfill its aims, the Act introduces a number of prohibitions, and it sets out various civil and criminal penalties. You can find more information on the USDA APHIS website.

Product scope

The Lacey Act concerns fish, wildlife, and plants. The Act makes it unlawful for any person to deal with (e.g. import, export, or transport) or attempt to deal with said items in violation of domestic or foreign laws. The following subsections cover consumer products that may be derived from fish, wildlife, and plants.

Plant Products

The term “plant” under the Act refers to any wild member of the plant kingdom and trees from either natural or planted forest stands, including:

- Roots

- Seeds

- Plant parts

- Plant products

The following are some plant products that may fall under the ambit of the Lacey Act:

- Product packaging and containers

- Furniture

- Essential oils

- Paper

- Musical instruments

Products containing fish and wildlife

The Act defines “fish” and “wildlife” as referring to any wild animal, whether alive or dead, including without limitation any:

- Wild mammal

- Bird

- Reptile

- Amphibian

- Fish

The definition includes such wild animals regardless of whether or not bred in captivity and includes any part, product, egg, or offspring.

The following are some examples of regulated wildlife that might be contained in jewelry or other products:

- Mother of pearl

- Black coral

- Red coral

- Feathers of some birds

You can find more information on this page.

Prohibited acts

The Lacey Act introduces numerous prohibitions to fulfill its aim and constitutes the main legal requirements that importers and manufacturers must observe. Note that sections contained in the Act may concern plants or fish and wildlife or both.

Offenses other than marking offenses

Section 3372(a) of the Act makes it illegal for any person to deal in (or attempt to deal in) fish or wildlife or plant in violation of:

- Any US legislation or treaty

- Any Indian tribal law

- Any foreign law

Additionally, the section specifies that it is unlawful to import, export, sell or purchase plants in violation of any US or foreign law that protects plants or regulates:

- The theft of plants

- The taking of plants from officially protected areas

- The taking of plants from an officially designated area

- The taking of plants without the required authorization

In relation to state or foreign laws affecting fish and wildlife, the Act does not specify what such laws do as it does for plants (see above).

The section also makes it illegal to take, possess, transport, or sell plants:

a. In violation of any state law or foreign law that governs the export or transshipment of plants

b. Without the payment of the following items as required by any state law or any foreign law:

- Royalties

- Taxes

- Stumpage fees

Marking offenses

Section 3372(b) of the Act makes it illegal for any person to transport, import, or export in interstate commerce any container or package of fish or wildlife unless its container or package has been previously labeled.

This section does not extend to plants or plant products.

False labeling offenses

Section 3372(d) of the Act makes it illegal for any person to make or submit any false labeling for any fish, wildlife, or plant which has or will be, for instance, transported in interstate or foreign commerce.

Note that this is a brief explanation of the section. Importers and manufacturers should seek legal advice if they suspect that they are violating the section.

Plant declarations

Section 3372(f) of the Act makes it illegal for any person to import any plant unless a declaration that contains the following items is filed upon importation:

a. The scientific name of any plant (inclusive of the genus and the plant species) contained in the importation

b. A description of the value of the importation and other information related to the plant

c. The name of the country from which the plant was taken

Note, that “any plant” in this context also refers to plant products (see the product scope section above). More about the declaration relating to plant products and the enforcement is be presented below.

The Act does not specify a declaration for imported fish and wildlife or products derived from fish and wildlife.

Exemption

Section 3372(f)(3) provides an exception to the declaration requirement for plants used exclusively as packaging material to support, protect, or carry another item. Note that this does not apply to the situation where the item that is imported is the packaging material itself.

Here are some examples of packaging materials that would be exempted:

- Shipping containers

- Cases

- Crates

- Drums

- Pallets

Who enforces the Lacey Act?

The Lacey Act has a number of agencies that enforces its provisions. The followings are some enforcement agencies and their respective responsibilities:

a. Animal and Plant Health Inspection Service (APHIS) – collects declarations for imported plants and plant products. Additionally, it sets the scope of plant materials requiring a declaration

b. U.S. Customs and Border Protection (CBP) – assists APHIS with the electronic collection of data to fulfill the import declaration requirement

c. U.S. Fish and Wildlife Service (FWS) – enforces the wildlife aspects of the Act

d. National Oceanic and Atmospheric Administration – enforce the aspects of the Act that relate to fish

The first two enforcement agencies are important to importers and manufacturers as they relate to plant products and the filing of the Lacey Act Declaration as described in subsequent sections below.

Lacey Act Declaration (USDA APHIS)

The Lacey Act Declaration applies to plants and plant products. The declarations fall under the responsibility of APHIS, an agency of the United States Department of Agriculture (USDA).

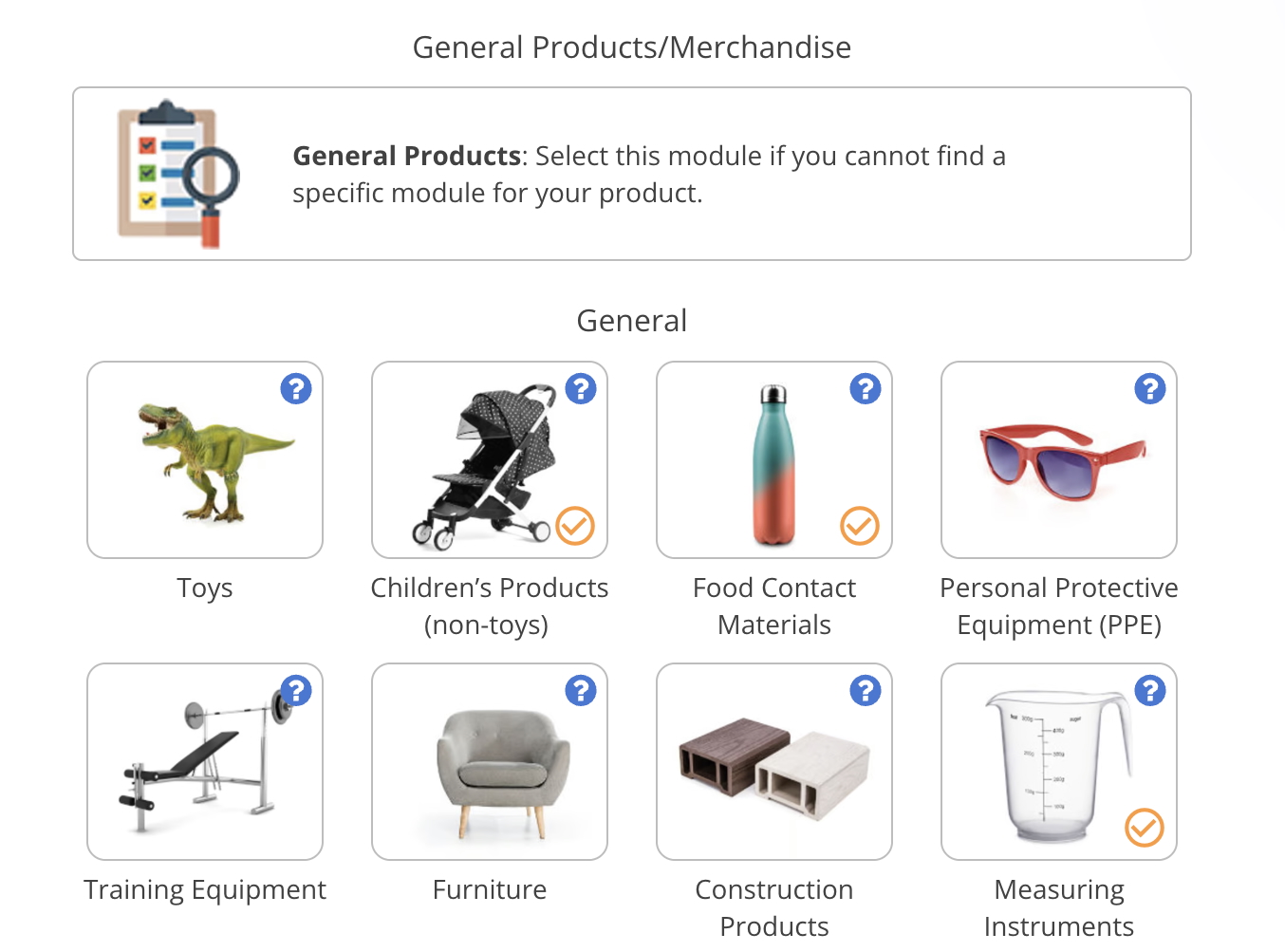

When do I need to fill in a declaration?

You would need to file the declaration if all the following conditions are true:

a. The imported product contains plant material

b. The imported product is classified under a Harmonized Tariff Schedule (HTS) code as listed on APHIS’ Implementation Schedule

c. The shipment is imported as a formal entry (the shipment has an aggregate value of $2,500 or more and is covered by a bond)

d. The shipment falls under any of these entry-type codes

Here are examples of imported products and their respective HTS codes that would require a declaration:

- Essential oils of sandalwood – 3301295139

- Wooden frames – 4414

- Tableware & kitchenware of wood – 4419

- Tools, tool handles, broom handles – 4417

- Pianos – 9201

- Bent-wood bedroom furniture – 9403504000

Filing the Declaration

As explained above the Act requires a declaration to be made upon importation, and the Customs and Border Protection (CBP) agency assists the APHIS with collecting data to fulfill the import declaration requirement.

Paper Declaration

You can file a paper declaration (known as the PPQ Form 505) by mailing the form to USDA APHIS. The address is contained in the form.

Electronic Declaration

However, nowadays, the primary method for fulfilling the declaration requirement is to file the declaration electronically through the CBP’s Automated Commercial Environment (ACE) system.

You may also file the declaration electronically through the Lacey Act Web Governance System (LAWGS). To learn more about LAWGS and pursue this option, you can contact the APHIS.

Who files the Declaration?

The Importer of Record (IOR) or their agent (e.g. a customs broker) can sign PPQ Form 505 or file a declaration in the LAWGS data system or the ACE system. The IOR is responsible for ensuring that the imported products comply with the customs and legal requirements of the country of import.

In the context of filing requirements, the IOR or his agent is responsible for the accuracy and truthfulness of the information provided. Failing to do so may result in civil or criminal actions, including the seizure and forfeiture of your products.

Other requirements for importing animal products

The US Fish and Wildlife Service (FWS) regulates the commercial importation and exportation of products made from fish and wildlife. However, unlike the case for plants and plant products, the Lacey Act does not specify a declaration.

Importers and manufacturers of animal products should still observe wildlife regulations, which are contained in 50 CFR Subchapter B.

For example, you should file a Declaration for Importation or Exportation of Fish or Wildlife (Form 3-177) (unless exempted) with the FWS at an authorized port of entry and receive clearance from them before US Customs releases your shipment.

Alternatively, you may declare your shipment electronically using the eDecs system.

What are the consequences of non-compliance with the Lacey Act?

The consequences for violating the Lacey Act can differ in severity depending on the violator’s level of knowledge about the illegal origin of the plant or plant product.

For instance, if section 3372(f) (relating to declarations upon importation) was knowingly violated and if it involved plant products with a market value greater than $350, then the violator (e.g. the IOR) might be fined or face imprisonment for not more than 5 years or both.

Even if the responsible party did not knowingly violate a requirement of the Act, the violator may still face criminal or civil penalties for failing to exercise “due care”.

Here are the possible ramifications for failing to comply with the Lacey Act:

a. It may attract civil penalties

b. It may attract criminal penalties

c. It may lead to permit or license sanctions

d. It may result in your goods upon importation being forfeited and seized

.png)

.png)

.png)